Fear and Loathing in Trader Hell: Week Ending April 11, 2025 – A Bipolar Bloodbath Bonanza

Dispatches from the Last Sane Bastard in This Casino

Welcome, you masochistic pikers, to the autopsy of a week that turned global markets into a slaughterhouse rave—indices convulsing like drunks on a Tilt-A-Whirl, stocks flayed raw, and the 10-year Treasury yield spiking to 4.515% like a guillotine blade that finally made Trump blink. It’s Sunday, April 13, 2025, and the past five days were a masterclass in insanity: Trump’s tariff jihad—10% universal, 125% on China—torched $5 trillion Monday, fueled a cocaine rally Wednesday (SPY to 545.18, Dow up 2,963), then puked it all back Thursday (SPY to 526.96, down 3.46%) and teased a suckers’ bounce Friday. The HST trinity—healthcare, tech, energy—bled and begged, while X screeched “crash” and “rigged” in a chorus of lunacy. This is Fear and Loathing in Trader Hell, where the charts are gory and the sarcasm’s free—let’s rip this bipolar corpse apart.

The Indices: A Rollercoaster to Hell and Back

The Dow Jones Industrial Average—30 wheezing dinosaurs—shed 3% net, a 2,200-point Monday gutting (to 38,856) erased by Wednesday’s 2,963-point howl (to 41,819), only to lose 1,014 Thursday (39,593) and tease 0.3% Friday. The S&P 500, a 500-headed hydra of greed, dropped 2% overall—$5 trillion torched Monday (SPY to 505.28), spiked 9.5% Wednesday (545.18), then bled 3.46% Thursday (526.96), with Friday’s 0.4% futures a cruel wink. The Nasdaq, tech’s fever dream, fell 4% net—8% Monday bear market plunge, 12.2% Wednesday roar, 4.31% Thursday flaying (to 16,387), and a 0.5% Friday flicker. The VIX hit 62 Wednesday, a banshee’s cackle, settling at 37 Friday—fear’s the only constant. Trump’s tariff pause was a junkie’s hit; the 10-year yield’s 4.515% peak screamed “recession,” folding his bluff like a paper tiger.

Notable Stocks: Pikers, Profiteers, and Penny-Stock Corpses

SPY: – Weekly Price: Monday’s 505.28 low to Wednesday’s 545.18 peak, Thursday’s 526.96 dip—market madness in neon.

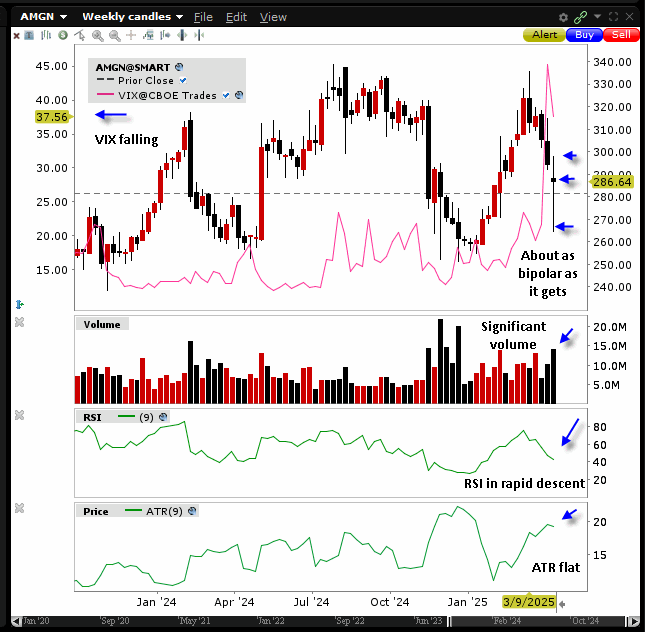

Amgen (AMGN) – Week: -8%

The biotech piker’s a flayed husk, down 8%—6% Monday plunge, 5% Wednesday bounce, 7% Thursday gutting. Tariff chaos shredded supply chains—HST’s healthcare leg’s a bloody stump. RSI at 30—oversold and choking on despair.

Nvidia (NVDA) – Week: -5%

The AI chip god’s a staggering degenerate, down 5%—14% Monday massacre, 7% Wednesday rip, 6% Thursday bleed. China’s 125% tariffs are a rusty shiv—HST’s tech heart’s twitching. Bollinger Bands wide as a grave—volatility’s the reaper.

Bloom Energy (BE) – Week: -10%

The fuel-cell dreamer’s a gutted wreck, down 10%—5% Monday, 7% Wednesday surge, 8% Thursday crater. Recession fears trumped domestic shield—HST’s energy vein’s clotting. 20-day moving average slits 50-day—death cross in crimson.

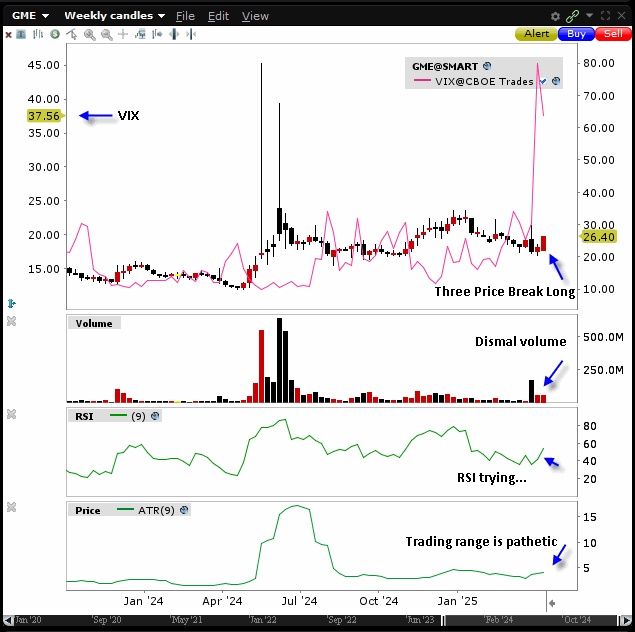

GameStop (GME) – Week: +15%

The meme-stock hydra’s a rabid beast, up 15%—12% Tuesday squeeze, 10% Wednesday madness, flat Thursday. Apes on X scream “MOASS”—not HST, just chaos laughing at math. Bollinger Bands explode—lunacy in neon.

That 10-Year Yield Tantrum

The 10-year Treasury yield hitting 4.515% this week (April 7-11, 2025) was a bond market Molotov cocktail that shook the Fear and Loathing in Trader Hell landscape, and here’s why it matters in this savage recap. In simple terms, the yield is the return investors get on the U.S. 10-year Treasury note—a benchmark for borrowing costs across the economy. When it spikes, like it did Wednesday, it signals investors dumping bonds, driving up rates and screaming “recession panic” louder than a VIX at 62.

Impact Explained:

Market Gut Punch: At 4.515%, the yield—highest since 2007 per X chatter—jacked up borrowing costs for companies and consumers. Stocks tanked Monday (SPY to 505.28, down $5 trillion) because higher yields make equities less appealing than “safe” bonds, especially for tech pikers like Nvidia (-5% week), who need cheap cash to grow.

Trump’s Tariff Fold: The yield’s surge reportedly spooked Trump into his “90-day tariff pause” tweet Wednesday (10% universal stays, China to 125%). Why? High yields tighten the economy—mortgage rates hit 7.2%, car loans 8%—choking his MAGA base. X posts say he blinked to avoid a voter revolt, not out of genius, giving SPY its 545.18 rally.

Bipolar Swings: The yield’s climb fueled volatility—Thursday’s SPY drop to 526.96 (3.46%) reflected fears of tighter Fed policy, despite rate-cut rumors. By Friday, the yield eased to 4.38% (real-time), teasing a 0.4% SPY futures bounce—a suckers’ rally our recap mocks.

HST Hit: Our HST stocks—Amgen (-8%), Bloom Energy (-10%)—felt the squeeze. Higher yields crush growth stocks (healthcare/tech) by hiking debt costs; energy’s domestic shield didn’t save Bloom from recession dread.

That 4.515% yield was the bond market’s middle finger, folding Trump faster than a MAGA hat in a hurricane—proof the real casino’s in the debt, not his tweets.

Fear the Swings, Loathe the Swindler

This week was a bipolar bloodbath—SPY’s $5 trillion Monday wipeout, Wednesday’s 545.18 cocaine high, Thursday’s 526.96 gutting, and Friday’s suckers’ tease prove the market’s a junkie with Trump’s finger on the needle. Amgen and Nvidia bled, Bloom’s a green corpse, and GameStop’s apes cackled over the rubble. The 10-year yield’s 4.515% was the real butcher, folding Trump’s tariff bluff while Goldman and algos shorted the chaos. X’s “rigged” howls ring true—the suits are clawing at trapdoors, cufflinks slick with panic sweat. Me? I’m here with my fourth Bloody Mary —which I am told is cheaper than therapy, wading through the gore, watching the charts twist like a hog in a slaughter chute. Fear and loathing’s the only winner—savage, raw, and spitting in the face of this bloody farce.

Join the Fear and Loathing in Trader Hell Chat—where pikers scream, SPY bleeds, and Trump’s tariffs get flayed. It’s a gonzo pit of sarcasm and charts. Dive in, you cheap bastards!

The description of the market this past week ALONE is worth subscribing! I busted a gut reading that and I know sweet fuck all about economics. I’ll tell ya what though, I’m paying attention NOW. Maybe I’ll just learn something here….🇨🇦👏