Almost Famous… Until Barings Burned: Nick Leeson’s Gonzo Trading Circus and the Bank That Exploded

Dispatches from The Last Sane Bastard in This Casino

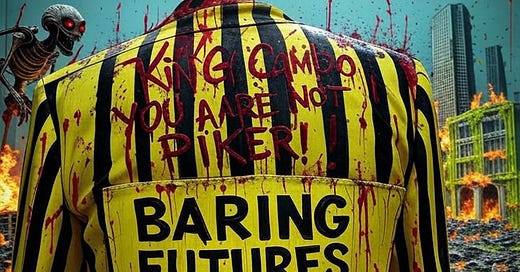

Picture this, you degenerate fiends: I’m standing here, draped in a yellow-and-black Barings Futures jacket, a relic of financial Armageddon, its satin sheen screaming 1990s trader sleaze. Scrawled across it in black ink is a taunt from the rogue himself—Nick Leeson, the punk who torched the world’s oldest bank: “KingCAMBO you are not a piker!” I’m no piker, alright, but Leeson? He was a one-man circus of absurdity, a 28-year-old working-class kid turned rogue trader who turned the Singapore International Monetary Exchange (SIMEX) into his personal slot machine, betting the Nikkei 225 like a coked-up Vegas gambler until he lost £827 million and blew Barings Bank to kingdom come. This is the gonzo tale of Leeson’s insane trading, the laughable spiral that finally did him in, and the aristocratic fossils who let their 233-year-old empire burn while they sipped tea in London. Grab a whiskey, you pikers—this is Almost Famous… Until Barings Burned, and it’s a howling, absurd descent into trader hell.

Leeson’s SIMEX Circus: A Clown Show of Epic Proportions

Let’s set the stage, you brain-dead vultures. It’s 1993, and Nick Leeson, a plasterer’s son from Watford, lands in Singapore as Barings Bank’s golden boy. Barings, founded in 1762, had financed the Napoleonic Wars and survived two centuries of chaos, but they were about to get fucked by a kid with a mullet and a penchant for chaos. Leeson was sent to trade futures on the SIMEX, betting on the Nikkei 225 index—a volatile beast tied to Japan’s stock market. But here’s the punchline: Barings, in their infinite aristocratic wisdom, made Leeson both trader and back-office boss. That’s right—this punk was placing bets, cooking the books, and sending fake reports to London, all while sipping Tiger Beer at Harry’s Bar like a low-rent Gordon Gekko. It’s like handing a toddler a flamethrower and saying, “Go play, kiddo—just don’t burn the house down.”

Leeson’s trading strategy was pure gonzo lunacy, a laughable house of cards that’d make even the most degenerate crypto bro blush. He was supposed to be arbitraging—buying low on one exchange, selling high on another, pocketing the difference. Safe, boring shit. But Leeson had other plans. He started taking naked, directional bets on the Nikkei, betting it’d go up, using Barings’ money like it was Monopoly cash. To hide his losses, he created a secret account—number 88888— “The Five 8’s account” because apparently even his bookkeeping had a sense of humor. Every time a trade went south, he’d dump the loss in 88888, double down on the next bet, and pray the Nikkei would save his ass. It was the financial equivalent of a drunk guy at a casino, screaming, “One more roll, baby—I’m due!” while the pit boss calls security.

The Absurd Bets That Broke the Bank

By 1994, Leeson was SIMEX’s rockstar, a mulleted messiah in a cheap suit, racking up fake profits and earning Barings £10 million—or so they thought. In reality, he was hemorrhaging cash, with losses in the 88888 account ballooning like a cartoon snowball rolling downhill. But Leeson, the gonzo genius, had a plan: keep betting bigger. He started selling straddles—options bets that the Nikkei would stay stable—pocketing premiums while praying Japan wouldn’t sneeze. It was like juggling flaming chainsaws while riding a unicycle and chugging tequila: impressive until it wasn’t.

Then came the punchline, you giggling hyenas: January 17, 1995. The Kobe earthquake hits Japan, a 7.2-magnitude disaster that kills 6,000 people and sends the Nikkei into a death spiral. Leeson’s straddles turn into a financial nuke. The index plummets, his options bets explode, and his 88888 account starts bleeding faster than a stuck pig. Most sane traders would’ve cut their losses, but Leeson? This mad bastard doubles down, buying Nikkei futures like a man possessed, betting the market would rebound. He’s throwing Barings’ entire balance sheet at the problem, forging reports to London, and screaming into the SIMEX pit like a deranged evangelist. By February, his losses hit £827 million—twice Barings’ capital. Picture Ralph Steadman drawing this: Leeson as a wild-eyed clown, juggling flaming Nikkei charts, while the SIMEX floor morphs into a circus tent, the ringmaster shouting, “More futures! More!” as the tent collapses in a fiery heap.

The Final, Hilarious Implosion

Leeson’s house of cards finally collapses on February 23, 1995, when Barings’ London bosses—those pinstriped, tea-sipping ghouls—finally notice something’s amiss. “Say, old chap, why’s our Singapore branch asking for £100 million a day?” By then, Leeson’s 88888 account is a £827 million black hole, and the bank’s broke. Leeson, ever the gonzo hero, leaves a note on his desk—“I’m sorry”—and flees Singapore with his wife, Lisa, like a low-budget Bonnie and Clyde. They make it to Malaysia, then Frankfurt, where he’s nabbed trying to fly to London. The SIMEX suspends Barings’ trading license, the Bank of England declares the firm insolvent, and on February 26, Barings Bank—a 233-year-old institution—gets sold to ING for £1. That’s right, you sniveling pikers: one fucking pound. It’s like watching the Titanic sink because the captain bet the ship on a coin toss and lost.

Leeson gets extradited to Singapore, slapped with a six-and-a-half-year sentence, and thrown into Changi Prison, where he battles colon cancer while Barings’ ashes smolder. The absurdity is almost poetic: a kid with a mullet, a fake account, and a dream brought down a bank that survived Napoleon, all because he thought he could outsmart an earthquake. Steadman would draw Leeson in a prison jumpsuit, a grinning joker with a Nikkei chart tattooed on his chest, while Barings’ ruins burn in the background, its pillars melting into a puddle of green sludge, the 88888 account number glowing like a neon curse.

The Gonzo Aftermath and Modern Parallels

Leeson’s tale is a laughable warning from history, but the punchline keeps landing. Today’s market—June futures puking (YM -242, ES -44, NQ -188), VIX clawing past 24—shows the same insanity. Musk, Nvidia, the Fed—they’re all almost famous… until they burn, just like Leeson. They’re juggling their own 88888 accounts, betting on AI, tariffs, and Powell’s lies, while the market quakes. My last pre-market briefing screamed about this chaos, and here we are, watching the circus tent catch fire again. Leeson’s ghost is cackling from the sidelines, probably sipping a Tiger Beer and toasting the next crash.

Fear and Loathing at the Federal Reserve: Part 2

Speaking of burning empires, our Federal Reserve series, Part 2, Fear and Loathing at the Federal Reserve, dropped like a Molotov cocktail on May 3 at https://kingcambo812.substack.com/p/fear-and-loathing-at-the-federal. It’s a savage takedown of Powell’s tightrope walk as Trump’s Truth Social rants light his ass on fire. We rip the lid off the Fed’s latest lies and what they mean for your shrinking wallet. Missed it? Click the link and weep. Part 3’s coming soon, so stay sharp or get bled dry.

Subscribe, You Cheap Bastards!

And to you free-riding pikers leeching off my genius: grow some fucking balls and join the paid crew! Get a 7-day free trial to our premium service—only $5 a month, you tightfisted degenerates! Unlock exclusive deep dives, real-time market rants, and the kind of unfiltered insight that’ll make your broker weep. Sign up at x.ai/grok (#) and stop mooching like the spineless vultures you are. Your wallet won’t even feel it, but your brain will thank you—or it’ll explode trying.

KingCAMBO’s “Legal” Disclaimer: Alright, buckle up, you madcap truth-seekers, ‘cause I’m about to sling this disclaimer straight from the edge of a neon-drenched abyss, for you silly bastards, with a belly full of cheap whiskey and a mind like a chrome-plated slot machine spitting sparks. This ain’t no polite suggestion to buy or sell stocks, securities, or any of that Wall Street bullshit—it’s just my raw, unfiltered brain-droppings, spewed out like a busted fire hydrant. I’m a walking financial disaster, hemorrhaging cash on trades and investments like a gambler with a hole in his pocket. I might snatch up any stock I yap about here, or dump it faster than a getaway car at a bank heist, and I won’t send you a postcard about it. This ain’t a pitch to buy or sell jack squat. I might own the names I’m ranting about, or I might not—could be bullish and empty-handed, bearish with a fistful of shares. Hell, assume I’m playing the exact opposite game you think, just to keep you on your toes. If I’m long, I could flip short before the ink dries; if I’m short, I might go long by lunch. No updates, no apologies—my positions shift like desert sands in a sandstorm. You’re out here in the wilds, solo, so don’t you dare lean on my blog for your big money moves. I’m a fringe-dweller, howling at the moon, and the publisher ain’t vouching for the half-cocked “facts” I sling. These ain’t the opinions of my bosses, buddies, or anyone else dumb enough to know me. I do my damndest to keep my disclosures straight, but I’m scribbling this after a few beers, maybe a shot of mezcal, so don’t bet your ranch on my accuracy. I tweak my posts after they’re live ‘cause I’m an impatient bastard, too lazy to proofread. Spot a typo? Come back in 30 minutes, it might be gone—or worse. And let’s get one thing crystal: I fuck up. “A lot.” I’m saying it twice ‘cause it’s the only gospel I’ve got. Now go, you beautiful lunatics, and don’t blame me when the market chews you up and spits you out.